How parents can protect their children when shopping online

When we grew up, children paid with cash at the corner store. Today, children are using smartphones, tablets and computers to make their purchases in apps, marketplaces, and eCommerce stores. As we move towards a cashless society, this trend is only going to continue.

Parents are right to be concerned by the underlying changes. As children haven’t yet fully developed their critical thinking skills, they’re particularly su susceptible to the highly targeted and tested ads from advertisers, not to mention the unscrupulous scammers waiting online.

In this article, we outline the three most common financial threats online and how parents can protect their children (and financial information). While better legislation and tighter controls may be the ultimate solution, for now, we focus on how parents can be pragmatic.

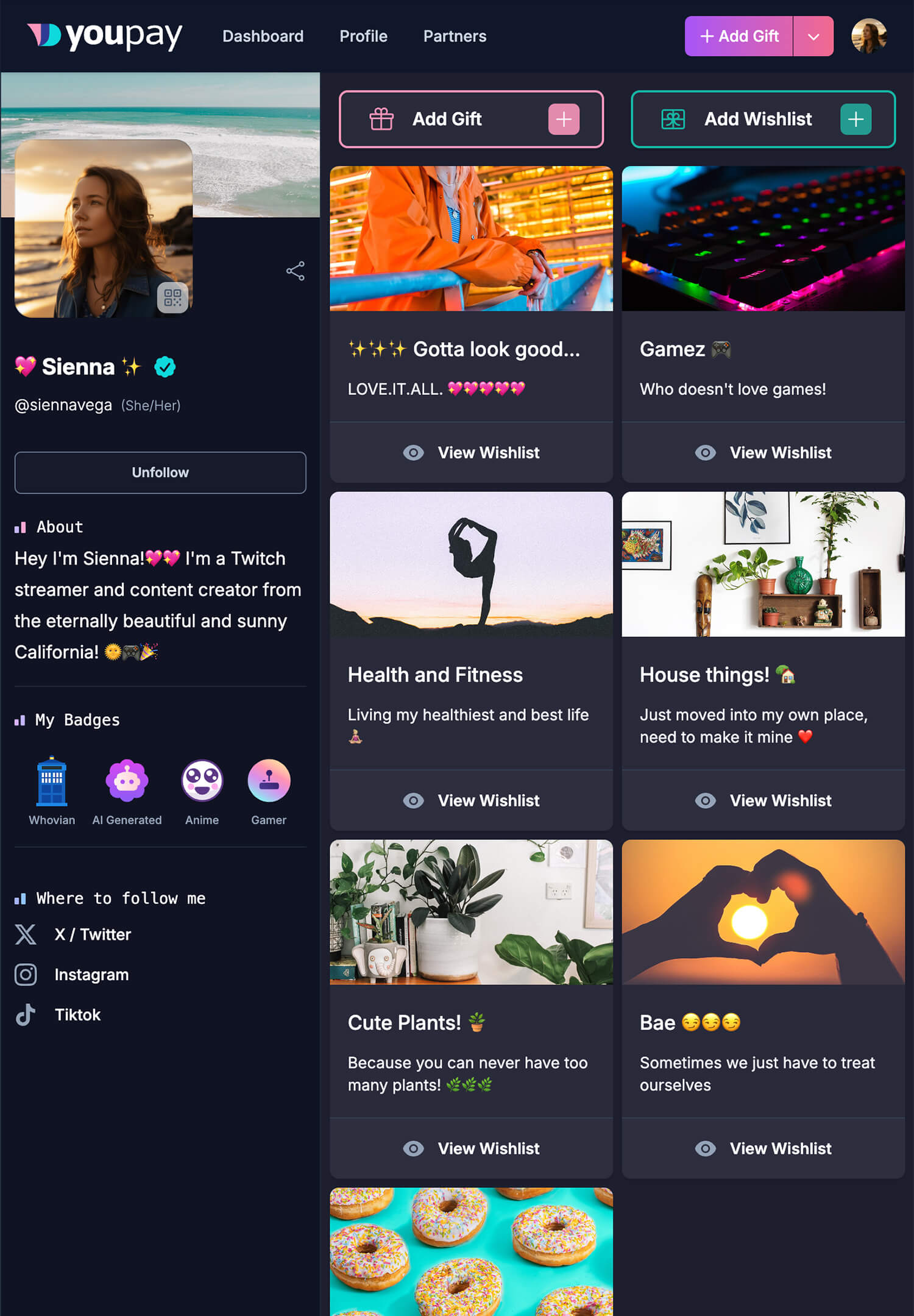

YouPay is a safe, secure and free way to let someone else pay for you. It protects children by giving purchasing control to their parents.

The three most common financial threats to children online

While these threats may seem alarming, as we’ll see later, there are proactive steps you can take to combat them.

1. Scams

More than ever, children are purchasing online. Unfortunately, they’re getting scammed. As ACCC Deputy Chair Delia Rickard noted, “Young people may think they are tech-savvy, but scammers are adapting and we expect to see more scams on newer platforms such as Snapchat and TikTok.” As Scamwatch reported, Australians under 25 lost over $5 million in 2019.

The most common online scams targeted at children include:

- Fees and charges hidden in the terms and conditions of otherwise legitimate purchases. It’s especially common on sites offering ‘free-trials’ or ‘free’ music downloads.

- Fake online stores offering too-good-to-be-true deals on in-demand items like iPhones.

- False promises. Within popular multiplayer video games, such as Fortnite, scammers convince kids to purchase special in-game items, but never transfer the item.

2. Identity theft

Of 40,000 American children surveyed in a study by Carnegie Mellon University, 10.2% had a third party illegally using their Social Security number. That’s 51 times higher than the 0.2% rate for adults. This can be even more damaging when children are targeted to access their parents banking details—especially when other pertinent information like their home address and password are also captured.

3. Overspending

When Microsoft surveyed 2,000 parents, they found 28% had children who made in-app purchases without their permission. Case in point, the five-year-old who spent A$3,100 in ten minutes playing Zombies vs Ninjas. Children don’t grow out of this habit.

A study by not-for-profit Financial Basics Foundation found 56% of parents had paid for their teenager’s overspending. Half of that overspending was with Mum or Dad’s credit card.

What can parents do to protect their children online?

It’s vital to take a proactive approach to keep your child (and your finances) safe online.

1. Set parental controls

Parental controls are essential. Ensure that you set computer usage time limits and block sites where they could make unapproved purchases. Also, switch off in-app purchases on their devices. When your kids want to buy a new gaming app, let them ask you first.

2. Internet security 101

We teach our kids to look both ways before crossing the road and never to get into cars with strangers. We also need to teach them the basics of internet security:

- Create strong and varied passwords

- Never make a purchase over public WiFi networks

- Check the site is secure and begins with HTTPS (not HTTP)

- Keep your software up to date

- Run antivirus software

- Never permit a website to store your credit card information

3. Digital pocket money

Giving kids pocket money for completing chores is still a great way to teach them the importance of hard work and saving. However, as money has become digital, kids need to learn how to manage their spending on the internet. After all, kids can still buy a Lego set online.

4. Double-check totals

Whenever your child asks you to review a purchase, always double-check the total, including taxes, shipping costs, and handling fees. It’s possible the website has made an error or has an inflated total. Even better, teach your kids to also check the total themselves.

5. Identify warning signs

When evaluating an online store, your child should know the warning signs of a fake website. Key signs to look out for include:

- Poorly designed

- Improper English with spelling mistakes

- Many negative reviews

- No returns policy listed

- When paying by credit card it doesn’t require the CVC

6. Select a secure payment method

It’s always best to use a proven payment method such as your credit card, PayPal, or Google Pay. When using your credit card, mark sure the site requires a CVC code during the checkout. If they don’t, never make the purchase.

Protect your children and financial information with YouPay

As we’ll see shortly, YouPay helps parents implement all of the above security tactics. Firstly, what’s YouPay? YouPay combines easy-to-use technology with prudent parental oversight. It lets your children safely shop online by giving parents control of the payment. Essentially, YouPay is a safe, secure, and free way to let someone else pay for you.

5 steps to ensure a safe and secure payment

Here’s how YouPay provides parents (payer) oversight of their children’s (recipients) online purchases:

- The child finds a product and places it in the shopping cart.

- The child sends the YouPay link to Mum or Dad.

- The parent checks and approves the purchase.

- The parent makes the payment.

- The online store ships the product.

How YouPay empowers parents to protect their children

As you can see, YouPay helps protect children against scams, identity theft, and overspending. Specifically, it empowers parents to take advantage of the solutions mentioned above:

- Parental control: Parents must approve every purchase.

- Internet security: Parents can pay securely from their device.

- Digital pocket money: Children can shop online to spend their pocket money.

- Check totals: Parents can check the items and costs before approving the purchase.

- Warning signs: Parents can ensure the site is legitimate before making the purchase.

- Secure payment method: Pay with secure methods like credit cards and PayPal.

The most important part of protecting children online is a prudent parent. They must not only protect them, they must teach their children how to shop online safely. We’re excited for YouPay to be part of that process.

If you’re a seller, you can support parents as they keep their children safe online. Learn more about adding YouPay to your online store.