Innovation is a powerful force. When a company creates a new technology that helps consumers do something quicker, easier, and cheaper—everybody wins.

While the traditional banking system and big technology companies have made significant contributions to our society, we believe that when oligopolies emerge, it’s often time to rebalance the scales. After all, innovation is most powerful when it supports healthy competition and empowers everyday consumers.

In this piece, we explore fintech innovation, analyse the growing challenge from big tech, and then introduce a new tool that empowers all retailers and every consumer.

YouPay a safe, secure and free way to let someone else pay for you. It’s like Amazon’s Wish List, but available to all retailers—regardless of the platform they use.

Fintech is a force for good

Since the financial crisis, much attention has been given to the ethics of Wall St. Scrutiny of the financial system extends far beyond bankings most famous street. As the Australian Government Productivity Commission reported, “Australia’s banking sector is an established oligopoly.”

Given that fintech is an extension of traditional finance, you may expect it has the same flaws. In reality, it’s the exact opposite. Fintechs are making the finance system faster, easier to use, and more affordable.

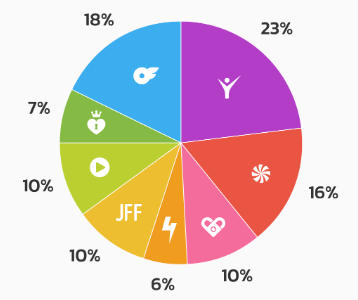

In Australia, we have many fintechs that are a force for good:

- Judo Bank is a challenger bank dedicated to serving small and medium sized enterprises.

- Athena has already saved customers over $70 million over the life of their home loans.

- Airwallex enables low-cost, high-speed and transparent international collections and payments.

- Sempo builds inclusive infrastructure and has worked with NGOs, including Oxfam and Mercy Corps.

- Up is a mobile-only bank that doesn’t charge monthly account keeping fees.

The positive impact isn’t only present in Australia. Innovative fintechs are challenging oligopolies by empowering everyday consumers across the globe, especially in the underbanked populations of India, Kenya, and Brazil.

Big tech is challenging fintech

Fintech still offers a huge opportunity. While this is exciting for entrepreneurs building innovative fintechs, financial technologies have captured the attention of big tech companies. They have the talent, capital, and infrastructure to compete—and dominate.

Big tech has charged into the fintech space. Google has Google Pay, Apple has partnered with Goldman Sachs, and Facebook tried to launch its own currency. Even Amazon is becoming a finance company. Last year, it lent $1 billion to the entrepreneurs who sell their goods on the company’s site.

Moreso, Amazon already has incredible market power. Beyond Amazon’s growing eCommerce monopoly, they have AWS and Alexa. Furthermore, they own Whole Foods, Twitch, IMDB, Zappos, and Audible. Not to mention, Jeff Bezos owns The Washington Post.

Traditional finance’s oligopoly is slowly being eroded by innovative financial technologies. However, with the emergence of big tech in the fintech space, we may be swapping one oligopoly for another.

Should fintech fight back?

Initially, fintechs captured market share from powerful financial oligopolies by building technologies that provided consumers faster, easier-to-use, and more affordable services. Is it time for fintechs to apply the same strategy against big tech?

Consider Amazon Wish List. It’s much like a gift registry, where users can add any item on Amazon and share it with friends and family. For example, a daughter can share a Wish List of school supplies and her Mum can pay for them. It’s a great tool. However, it’s only available within Amazon’s ecosystem.

What if there was a way to leverage this idea—but instead of it serving a big monopoly—it served thousands of smaller retailers? Well, that’s why we created YouPay.

An Amazon Wish List for every store

YouPay a safe, secure and free way to let someone else pay for you. The key difference between Amazon Wish List and YouPay is that every retailer can use our tool. You don’t have to be part of Amazon’s oligopoly.

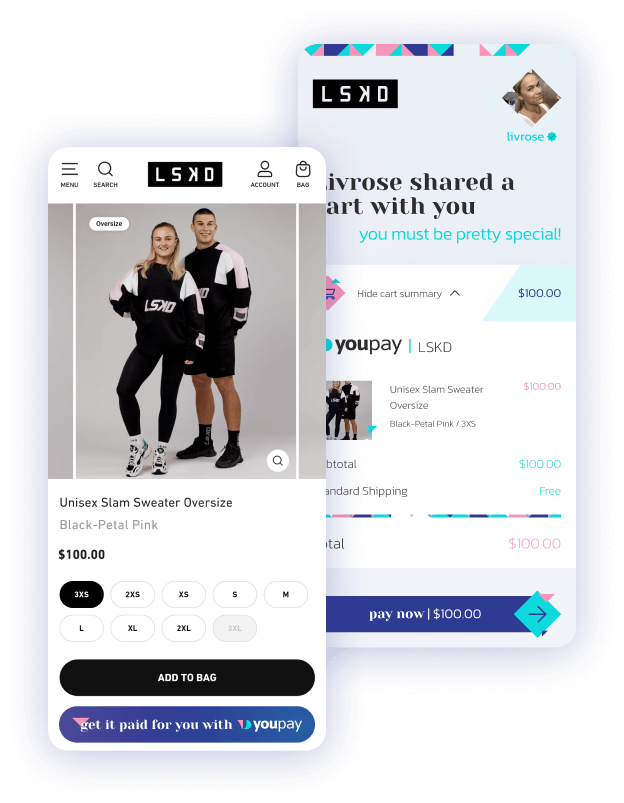

Here’s how YouPay works, with the same example of a Mum paying for her daughter’s school supplies:

- Daughter (recipient) adds school supplies to her online shopping cart.

- She selects YouPay as her payment option during checkout

- She sends the link to Mum (payer).

- Mum checks the link and pays for the school supplies.

- Retailer (seller) ships the school supplies to the daughter.

In fact, you will even be able to use YouPay in a brick and mortar business. We support all retailers to compete with Amazon and the growing big tech oligopolies.

In a time where oligopolies and monopolies are gaining power, YouPay’s technology supports a competitive marketplace that benefits consumers. If you’re a retailer, see how you can increase sales.